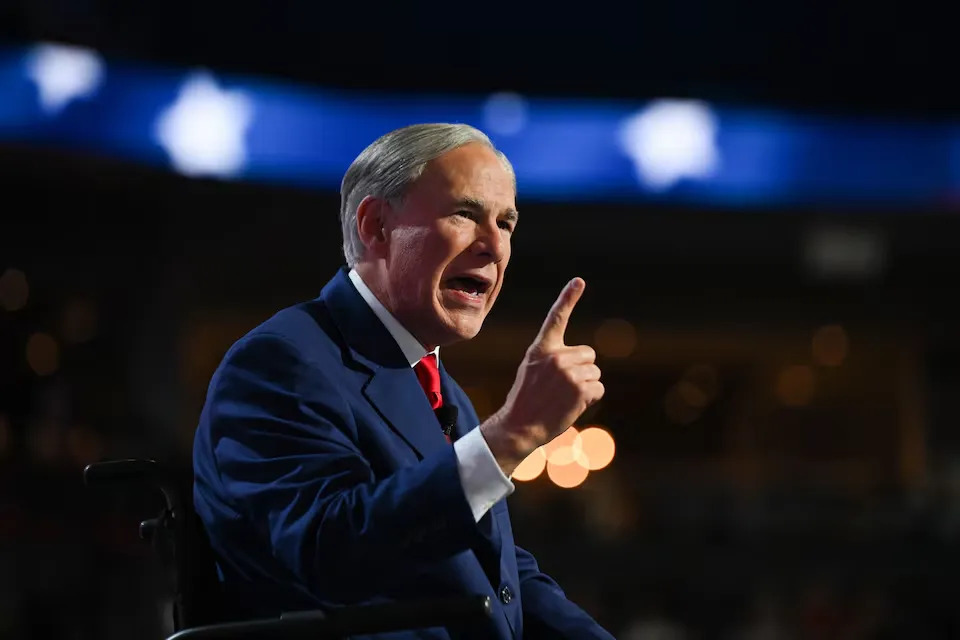

According to the latest news released on the official website of the Texas Governor, Abbott has officially issued instructions to all relevant agencies in the state to prohibit any new investment in China and require existing investors to fully withdraw from China's venture capital sector.

He also emphasized the need for all institutions to take measures to protect themselves from possible cyber attacks and infiltrations by China.

He believes competitors such as China could pose a threat to Texas' finances and decisive steps must be taken to guard against these risks.

Texas is the second largest state in the United States, and Governor Abbott’s decision seems to be in line with the policy tendencies of Trump who has come to power.

Trump has always advocated indiscriminate strikes and emphasized the need to reduce economic ties with China. Abbott’s order for state agencies to divest from Chinese investments was issued after Trump took office, and it’s hard not to associate it with Trump.

Texas has been taking an aggressive stance on investments in its institutions, including the Texas Teachers Retirement System (TRS), which manages $210.5 billion as of the third quarter of this year according to its annual report.

TRS has about $1.4 billion in yuan and Hong Kong dollar asset exposure and is listed on Tencent Holdings. As its 10th largest position, it's worth about $385 million at current prices.

In the letter, Governor Abbott said he told the University of Texas/Texas A&M Investment Management Company (UTIMCO), which manages nearly $80 billion, to divest from China earlier this year.

This time, Abbott's order to divest from China and the three executive orders he issued this week not only reflect the new reality of Sino-US relations, but also reflect the domestic vigilance and precautions against China's rise.