14,500 wealthy people have left the UK

This is a mansion that Hui Ka Yan bought in London for 2 billion. It covers an area of nearly 6,000 square meters and has 45 rooms. It is in an excellent location. You can see London's iconic building: Hyde Park when you open the window.

This mansion was bought by Hui Ka Yan from a Saudi prince. Since he didn’t like the Islamic-style decoration, Boss Hui changed the decoration into a “nouveau riche” style with a wave of his hand. He used gold leaves as ornaments and decorated the interior of the entire mansion to be more luxurious than the British royal palace.

Around 2015, there was a wave of investment in the UK among Chinese billionaire.

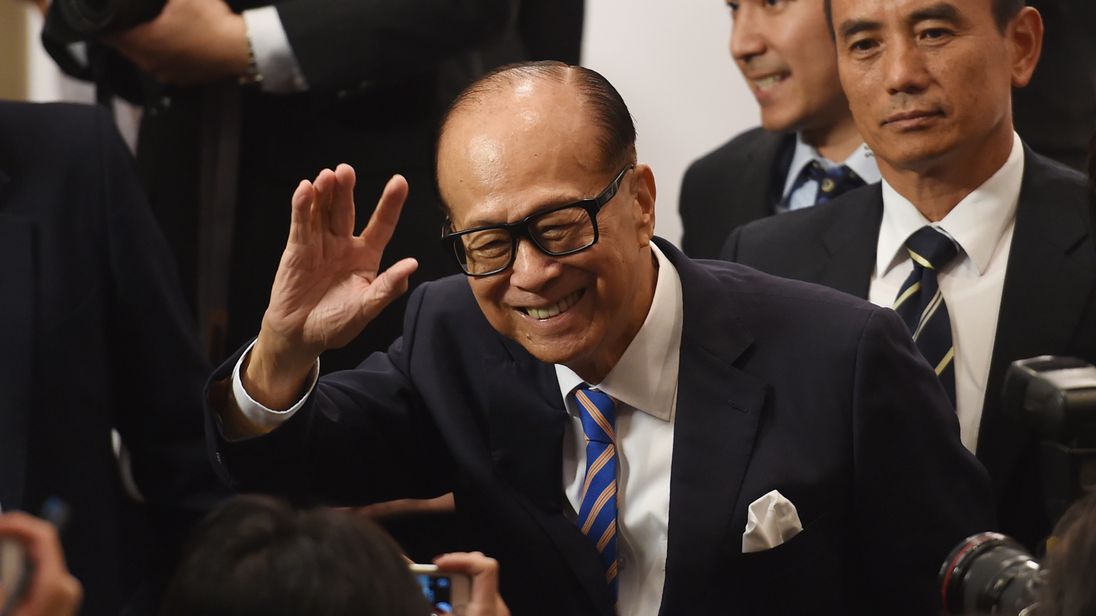

The leader is Li Ka-shing, who has spent US$41.05 billion and is called by the media as "buying half of the UK"; closely followed by Hong Kong's second-tier tycoons, Joseph Lau, Samuel Tak Lee, Lai Wing-to, etc., each of them spent at least more than US$1.368 billion to purchase real estate in the UK; followed by mainland China tycoons, such as Wang Jianlin, Hui Ka Yan, Cheung Chung-kiu, Richard Liu, etc.

At that time, Wang Jianlin, who was still the richest man in mainland China, was full of praise for the British investment environment, saying that the British market was the country with the highest degree of freedom in the world, and no investment was required to be approved.

That year, he invested US$5.47 billion in the UK, of which US$917 million was used to buy land and build high-end apartments, which were convenient for living in or renting out.

Why do China's richest people love Britain so much? Is it just the convenience of investing in the UK?

Of course not. They also have an unexplainable reason, which is the "Non-doms regime". This law allows wealthy foreigners to avoid paying tax on income earned in their home country while living in the UK.

The advantage of this law is that it allows entrepreneurs whose identities are sensitive and who are inconvenient to immigrate to live in the UK and enjoy the same benefits while continuing to remotely control domestic enterprises without worrying about being taxed twice.

In 2021, when Hui Ka Yan bought a mansion in London, 68,000 rich people around the world made the same choice as him. The largest number of them were from Russia.

Unfortunately, beautiful flowers don't always stay in bloom.

Starting from April this year, the UK decided to tax these foreign wealthy people regardless of whether the money they earn in their home countries is remitted to the UK. The tax rate is not low, as high as 12% to 16%.

As soon as the news came out, the fastest reaction was from Hong Kong's wealthy people. This group of time-tested "capitalist warriors" immediately sold their British properties and returned home:

Lai Wing-to sold two office buildings.

Joseph Lau sold two shops and a luxury house

Samuel Tak Lee, who bought 27 houses, felt that selling them one by one was too troublesome, so he simply made an asset package and sold them all at once.

These are transactions that can be seen on the surface, but there should be more transactions that cannot be seen.

Why does the UK rush to target wealthy foreigners?

The reason is simply that the government is out of money and the high welfare system is crumbling.

In the past ten years or so, hundreds of thousands of illegal immigrants have poured into the UK, mainly from Africa, India, and the Middle East, and they have almost depleted the national treasury.

This group of people followed a very wild approach. They first used a large boat to transport the people a few nautical miles away from the British coast, and then used kayaks to land. This method of smuggling in small groups is like guerrilla warfare. Any British coast may become their landing point, making it difficult to prevent.

Last year, 25,000 "black uncles" became British citizens in this way. There are not even 40% pure white people in London. The rest are all African, Indian and Middle Eastern.

Africans don’t go to work and have children at home, and their children are not well educated. When they grow up, they steal and shop around for zero dollars.

Indians are slightly better off and can work, but their salary is only half of that of British, which makes ordinary British miserable.

People of Middle Eastern descent are even more awesome and like to do small businesses. Street stalls have been set up in front of Buckingham Palace, and the police don't dare to control them.

These immigrants take up a lot of public resources.

It used to take a month for British to wait in line to see a doctor, but now it takes three months; public schools are overcrowded, and there are white, black, yellow, and brown people. Some Chinese parents, in order to allow their children to enter school, bring domestic "school selection fees" and bribe principals, making the education system a mess; in addition, the prices of food, water and electricity bills, and rent in the UK have repeatedly hit new highs, causing public resentment.

When the newly elected Labour government did the calculations, it found that to maintain the current welfare level, there is at least a £40 billion fiscal gap every year. The British voters are a group they dare not offend, but they do dare to target foreign billionaires who don't have voting rights.

In fact, the Labour government is fully aware of the consequences of the abolition of this tax-free policy. But the problem now is that the financial problem cannot be solved. Before the foreign wealthy people run away, they can make a fortune. Let's get through this year first.

By the end of 2024, 14,500 wealthy people have evacuated the UK, ranking second in the world. Where did they go with the money? No one can tell.