In the British town of Bolton, there is such a dilapidated townhouse: with peeling paint on the window sill and an overgrown front yard, it looks like an ownerless house.

However, behind this seemingly neglected house lies an empire of "shell corporation" purported to be worth £50 billion. These companies not only falsify financial statements and post bizarre recruitment ads, but also attempt to register with the UK's Financial Conduct Authority (FCA) to masquerade as legitimate financial institutions.

"The terraced house that no one noticed is worth only £155,000, but it hides a secret of £50 billion"

The media cited investigations showing that this dilapidated house in Bolton is the registered address of a number of "multinational companies", including "1 Stallion Limited" which claims an annual turnover of 12.5 billion pounds, "e-bank Ltd" which claims an annual turnover of 952 million pounds, and "Avantulo SA Ltd" which claims to have a share capital of 12.5 billion pounds. The financial statements submitted by these companies were riddled with errors and spelling problems and were clearly fake.

In addition, these companies also publish bizarre recruitment advertisements through social media in an attempt to create a false sense of legitimacy. For example, "Stallion Holdings Ltd" once advertised for a "25 to 30-year-old, single and good-looking woman" to serve as an "executive secretary" with an annual salary of only £4,788.

In the UK, any company that wants to become a bank must obtain a license from the FCA. In 2017, Stallion Financial Investments plc applied to the FCA to provide regulated financial services, but was rejected because it failed to respond to the regulator's questions. The company was subsequently dissolved for failure to file financial statements.

However, a year later, a new company named AR Worldwide Services Ltd was established and successfully obtained FCA registration as a small payment institution. The first director of this company was none other than Stallion Holdings Ltd. The substitution was thus accomplished~

Small payment institutions may offer a limited range of payment services, including foreign exchange remittances. However, according to investigations by British media such as the Daily Mail, almost all these financial companies provide money laundering services.

Because regulatory agencies cannot quickly and effectively verify the authenticity of business, cases of casual use or even stolen addresses to register companies are common in the UK. Many innocent people even sit at home and evade taxes for no apparent reason:

“Cardiff apartment owners receive tax bills from 11,000 Chinese companies”

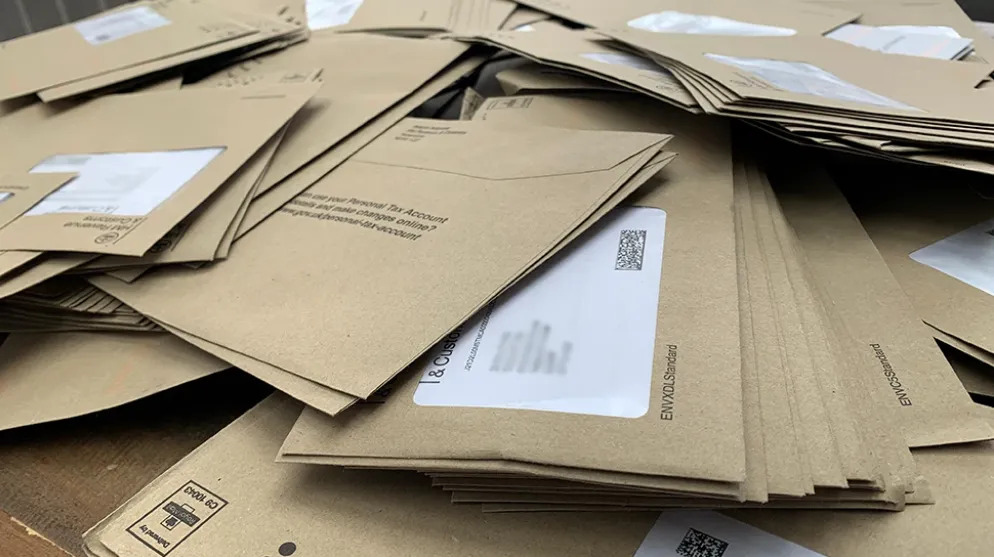

In 2022, Dylan Davies, a resident of Cardiff, opened his mailbox and was surprised to find 580 brown envelopes. Within just half a year, he had received tax bills from 11,000 Chinese companies.

It is understood that these companies had misappropriated his Cardiff address to register for value - added tax, resulting in nearly £500,000 worth of tax bills landing on him.

The HMRC provided clarification to Davies after he reported the situation, but apparently failed to take effective steps to deal with the situation. Since then, letters have continued to flow into his mailbox.

Although he felt deeply wronged, Davies was worried that if the problem wasn't properly resolved, his credit record would be affected and he might even lose his apartment due to these false charges. So, he escalated the matter and reported it to the BBC.

At this time, the HMRC began to take the matter seriously and untied all available accounts related to Davis's address.

For overseas companies, having a British registered address can provide them with tax exemptions and conveniences. Since there is almost no need to undergo any authenticity verification when registering, many overseas companies have taken advantage of this procedural loophole to open "branch offices" in the UK, turning many residential areas into "fraud parks" overnight.

"We are very confused," said a resident of Scam Street in the UK who said his address became a Chinese company.

A residential neighborhood in Swansea called Rhos Road has become the headquarters of a Chinese livestock company.

Dan Neidle of the think tank Tax Policy Associates expressed deep concern about the findings.

Neidle said, "The true purpose of these companies may be illegal activities such as money laundering. It's disturbing that they were able to pass the FCA's registration, which could mislead the public into thinking that they are legitimate."

Neidle and other experts called for increased scrutiny of company registration and financial regulatory systems to prevent more fake companies from exploiting loopholes to commit fraud and money laundering. They emphasized that the public should be highly vigilant about companies that claim to have huge assets but have registered addresses in ordinary residential buildings.

There has been no response to the call at the Bolton house, with neighbors saying they know nothing about the residents. However, the "shell corporation" empire behind this dilapidated house may weave a web of fraud and crime around the world.