01 Amazon dominates the Japanese market

Amazon’s global influence remains unrivaled, it turns out.

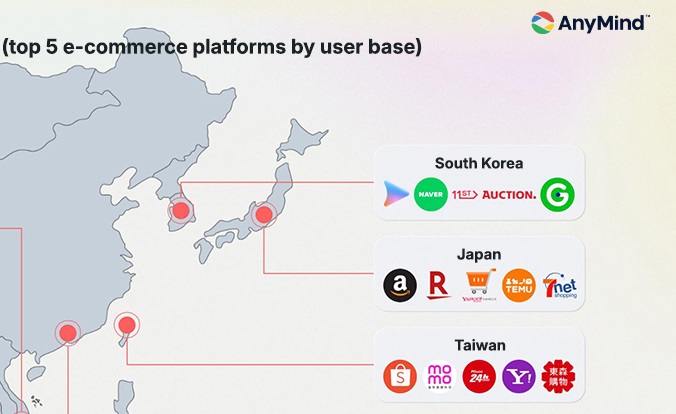

According to the news, recently, the business empowerment company AnyMind released the "2025 Asian E-commerce Report", focusing on the top five e-commerce platforms and social media platforms in East and Southeast Asia. Among them, Japan, as the world's fourth largest economy and one of the most economically developed countries in Asia, has attracted the attention of a large number of e-commerce sellers.

According to a report released by AnyMind, the top five e-commerce platforms in the Japanese e-commerce market are Amazon Japan, Rakuten, Yahoo Shopping, Temu and 7net.

Among them, Amazon has a clear leading advantage. With 67.24 million monthly active users and more than 130,000 e-commerce sellers, it firmly occupies the top spot in the Japanese e-commerce market. Although Rakuten, which ranks second, has attracted many consumers with its points system, its overall e-commerce sales performance is still slightly lower.

In fact, since its launch in Japan in 2000, Amazon's sales have been growing rapidly. The site's sales have continued to grow at a double-digit rate from 2016 to 2021. As of December 2023, Amazon's annual sales in Japan have reached 3.67 billion (approximately US$26 billion), a year-on-year increase of 6.6%.

It is worth mentioning that while Amazon dominates the Japanese market, it also brings development opportunities to Chinese cross-border sellers. Official data shows that in 2023, the overall sales of Chinese sellers on Amazon Japan increased by more than 20%, and the number of Chinese sellers with annual sales exceeding one million US dollars increased by more than 40% year-on-year.

02 Ten years of sharpening a sword

As the saying goes, "It takes a good blacksmith to make good steel." Amazon's ability to continuously lead the highly competitive e-commerce market in Japan is underpinned by the platform's persistent and diligent efforts.

AnyMind emphasized in the report that Amazon's investment in Japan in 2024 exceeded 1.3 trillion yen, and it indeed spent a lot of money. Judging from the flow of funds, Amazon's layout in Japan is mainly focused on the logistics field.

For example, in August 2024, Amazon announced that it would add an additional 25 billion yen (approximately US$169 million) to its previous investment to strengthen the construction of the last-mile delivery network in Japan. In addition to expanding the delivery network, this investment also involves reducing re-delivery and expanding delivery plans.

As the saying goes, "Heaven rewards the diligent." In 2024, Amazon's logistics and distribution speed in Japan will reach a higher level. The number of goods delivered on the same day or the next day throughout the year will exceed 780 million, a year-on-year increase of 15%, setting a new high in history.

The record-breaking number of goods delivered on the same day or the next day also shows that Amazon's logistics network layout in Japan has been relatively complete. Under this premise, Amazon also intends to shift its development focus to other areas.

Amazon Web Services (AWS) previously announced that it will invest 2.3 trillion yen (approximately US$15.5 billion) in Japan by 2027 to expand data centers in Tokyo and Osaka, strengthen business operations, and provide some artificial intelligence services to Japanese enterprise customers.

It is foreseeable that as Amazon continues to make plans in the Japanese market, the platform's leading advantage will become more and more obvious in the future. Old rivals such as Rakuten and Yahoo must work harder if they do not want to fall behind.