On the afternoon of the 3rd, the U.S. House of Representatives passed the 'Big Beautiful Bill' promoted by President Trump with a vote of 218 in favor and 214 against. Domestic concerns in the United States are that the bill will further exacerbate the U.S. fiscal deficit and debt risks.

The 'Big Beautiful Bill' is Trump's signature legislative agenda after returning to the White House in early 2025. The main contents of the bill include extending the corporate and personal tax cuts passed by Trump in 2017 during his first term, exempting tips and overtime wages from tax, etc. Its core provision is to reduce corporate taxes.

The bill has been controversial for cutting federal aid, increasing long-term debt and cutting taxes for the wealthy and big businesses. The New York Times pointed out that this bill puts the United States on a new and more dangerous fiscal path. Preliminary analysis shows that the bill will not only increase the U.S. deficit by approximately $3.3 trillion over the next 10 years, but also reduce the country’s tax revenue for decades. Such a shortfall could cause the U.S. fiscal trajectory to begin to change dramatically and heighten fears of a debt crisis.

Riedl, a senior fellow at the Manhattan Institute, an American think tank, said this may be the most expensive piece of legislation since the 1960s. The danger is that Congress will add trillions of dollars in new borrowing on top of an already massive deficit. Jason Furman, who served as chairman of the Council of Economic Advisers during President Obama's term, said the bill could make it harder for lawmakers to get the debt under control.

Currently, the U.S. national debt has reached $36.2 trillion. U.S. media pointed out that the bill will further expand the structural deficit as U.S. debt has reached a record high. “America’s growing debt burden will punish future generations.”

Bill cuts Medicaid, leaving over 10 million people without health insurance

Many politicians in the United States have criticized the tax and spending bill as "robbing the poor to give to the rich" and will increase the U.S. debt and deficit by trillions of dollars.

U.S. Congressman Adam Smith believes that the bill "actually increases the debt and deficit by trillions of dollars" and is intended to "give more power and wealth to the richest Americans and punish working people." Rep. Pramila Jayapal said the tax and spending bill was a "cruel and horrific betrayal."

John Rico, deputy director of policy analysis at the Yale Budget Lab, said the bill would make "low- and middle-income Americans worse off," and cuts to aid programs such as Medicaid would have the greatest impact on this group.

The bill would significantly revamp the federal Medicaid program, which currently covers about 71 million people. According to estimates from the Congressional Budget Office, the new bill will cause nearly 12 million people to lose health insurance.

Bobby Mukkamala, president of the American Medical Association, warned that this move would severely hinder Americans' access to timely diagnosis and treatment. "This consequence is disappointing, angering and unacceptable."

Greg Kelly, chairman of the medical branch of the International Union of Services, called the bill "a moral failure" that would threaten the stability of medical jobs and the normal operation of the entire medical system.

Roy Mitchell, Executive Director of the Mississippi Health Advocacy Project: We feel that in terms of Medicaid, the House version of the bill is terrible, but the Senate version is even worse. Some hospitals are facing closure, and the bill will directly impact hospitals in rural areas.

Clean energy company CEO: New plan will cost employees their jobs

Part of this U.S. bill will not only end government support for clean energy industries such as wind and solar power, but also impose new taxes on future projects in the industry. Provisions of the bill provide that wind and solar projects that come online after 2027 will not be eligible for tax credits. Some industry groups said the move could "destroy" the U.S. clean energy industry.

Will Etheridge, the head of a solar equipment company in North Carolina, USA, recently sent a warning message to the company's 190 employees, saying that because the new bill stipulates a significant reduction in tax credits for the clean energy industry, it will cause considerable harm to the company, and more than 50 people in the team are likely to lose their jobs.

Will Etheridge, CEO of Southern Energy Management: This bill will bring a lot of pain, confusion and frustration to the industry.

Etheridge's company is mainly responsible for installing solar panels on the roof of houses to achieve energy saving effects. In recent years, several clean energy companies like Etheridge have announced more than $20 billion in clean energy investments in North Carolina. Etheridge said that if the company's performance is hit hard by the new law in the future, customers will ultimately foot the bill.

The US think tank Rhodium Consulting issued an early warning before the new bill was passed, saying that if the bill is finally passed, up to 72% of the new wind power and photovoltaic projects originally planned in the United States in the next ten years will face failure, which will cause Americans' energy bills to rise significantly. Not only that, it will also shake the foundation of the United States’ participation in global new energy competition.

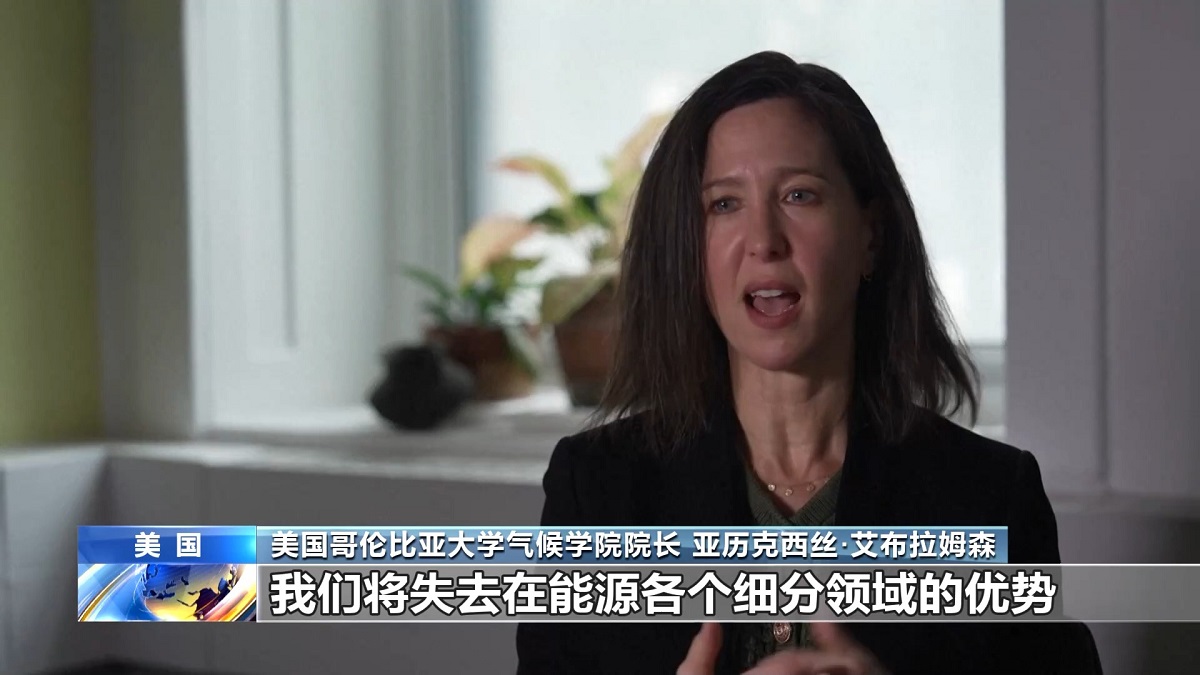

Alexis R. Abramson, Dean of the Columbia University Climate Institute: We will lose our advantages in various energy segments, thereby slowing down the energy transition, slowing down our global competitiveness, and putting us at a disadvantage and no longer a leader in innovative energy.