Mexico, a country with a population of nearly 130 million and a booming economy, is undergoing profound changes in the payment field.

Despite its long monetary history, cash has long been the primary method of payment, but the rise of new trends is accelerating the digital payments revolution, pushing Mexico toward a new era of digital payments.

01 Current status of payments in Mexico: Transformation from cash-dominated to digital payments

The continued dominance of cash

Mexico's cash dependence is more prominent among American countries. PCMI data shows that as of 2022, of the $476 billion in payment transactions, 66%, or $315 billion, was paid in cash. In terms of banking, just under half (49%) of the population had a bank account.

There are multiple reasons behind this heavy reliance on cash. For low-income groups, financial inclusion is elusive and high bank fees, commissions and interest rates make them feel no need to open a bank account. At the same time, low levels of financial literacy and distrust of the banking system also promote the use of cash and keep the informal economy functioning to a certain extent.

Initial developments in digital payments

Payment trends in Mexico are shifting towards digital. Thunes data shows that although digital payments currently account for a relatively small proportion, only 7% of payment transactions ($34 billion), it has shown a positive development trend.

On the one hand, the proportion of card payments reached 27% ($127 billion). On the other hand, the use of non-cash payment methods is gradually increasing. Since 2023, cash use in stores has fallen by 23%, while the proportion of consumers using contactless credit cards has increased from 1% to 5.1%, and contactless debit card use has increased from 3.6% to 8.6%.

02 Mexico is expected to move further towards digitalization in the payment field

Increased mobile and broadband penetration

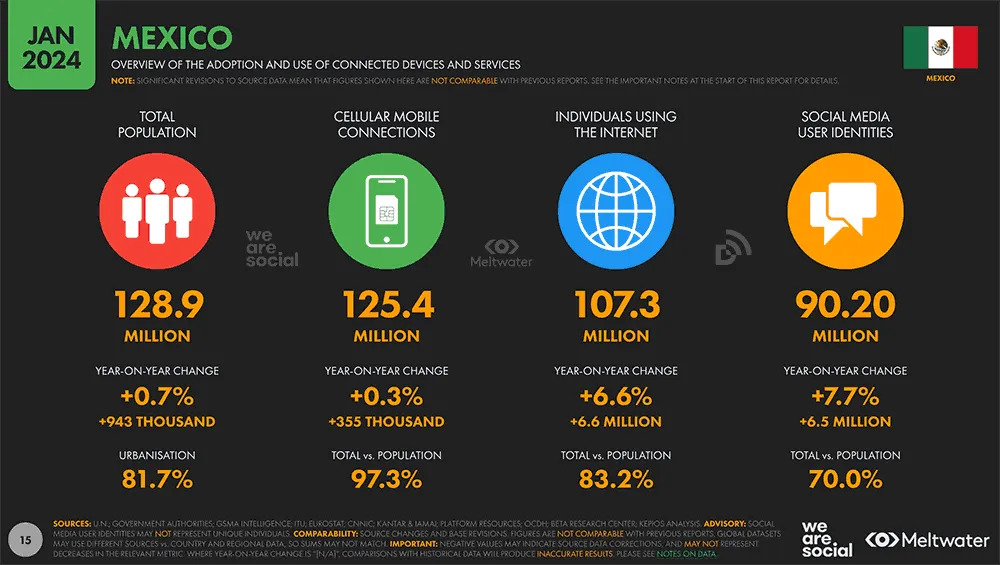

Internet and mobile technology are growing rapidly in Mexico. DataReportal data shows that as of January 2024, the number of Internet users in Mexico exceeded 100 million, accounting for 83.2% of the total population, and as of early 2024, there were 125.4 million cellular mobile connections active. Median mobile internet connection speeds have increased by 4.4% since 2023, and fixed internet connection speeds have increased by 20.8%.

Among them, Generation Z aged 11-26 is the largest group of Internet users. Mexicans spend an average of 4 hours and 37 minutes on their mobile phones every day. This high usage rate makes smartphones an important driver of change and provides an ideal carrier for digital payment.

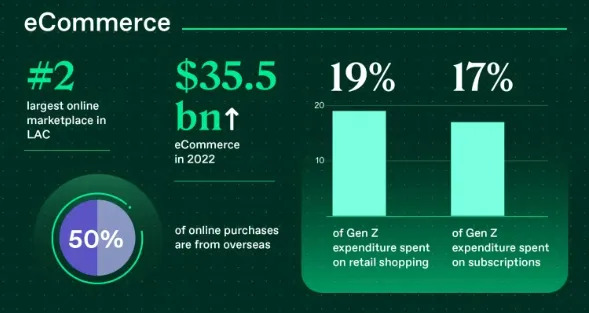

The development of e-commerce

E-commerce in Mexico is in a phase of rapid growth. According to INTERNATIONAL TRADE ADMINISTRATION data, Mexican e-commerce sales will increase by 23% to US$35.5 billion in 2022, becoming the second largest online market in Latin America. The number of e-commerce users is expected to exceed 77 million by 2025.

Online shopping features such as door-to-door delivery, time saving and more product choices are attracting consumers. In the process, the advantages of digital payment will be further highlighted.

Government policy promotion

The Mexican government is actively promoting digital transformation in the payment field. CoDi (Cobro Digital), launched in 2019, is a nationwide QR code and contactless payment system. Data reported by lexology shows that CoDi has grown to more than 15 million accounts as of 2022. This policy initiative helps improve financial inclusion and increase digital transactions.

03 Development trends of major payment methods in Mexico

Real time payment

The development of Mexico's real-time payment network began with the SPEI platform in 2004, and the launch of CoDi in 2019 further promoted this process. Against the background of the growth of global real-time payments, this move by the Mexican government will help improve the efficiency of financial transactions and promote operations such as same-day payments, inter-bank transfers and third-party payments between different bank accounts.

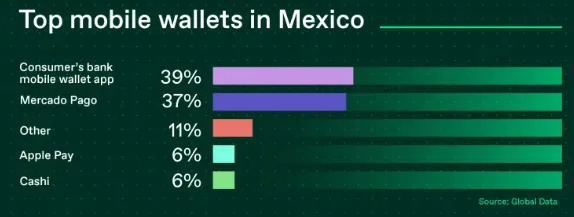

Digital wallet

The future development potential of digital wallets in Mexico is huge. This Week In Fintech data shows that while the proportion of in-store consumers currently using digital wallets has only increased slightly to 2.8% from 2.2% last year, it is expected to increase as merchant acceptance increases, broadband connections improve and government incentives are implemented. Growing at a CAGR of 14.3% to reach $5.1 billion by 2028. For the unbanked population, digital wallets are expected to surpass traditional banks as the primary financial services alternative.

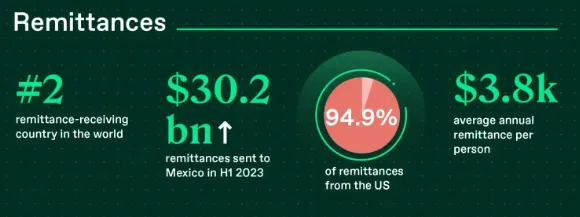

Cross-border transactions and global remittances

Since a large number of Mexican workers go to work in the United States, cross-border transactions, especially remittances with the United States, are huge. Mexico News Daily data shows that global remittances to Mexico in the first half of 2023 totaled US$30.2 billion, an increase of 9.9% over 2022.

Digital payment methods have huge potential to streamline the acceptance and disbursement of these remittance funds, with the value of digital remittances expected to grow at a CAGR of 6.47% to $421 million by 2027.

B2B payment

Most B2B payments in Mexico still rely on cash, and less than 1% of B2B payment transactions have moved online. However, with the rise of nearshoring and the United States' push for near-shoring manufacturing, Mexico's manufacturing exports to the United States are expected to grow significantly. This will prompt companies to seek more convenient payment methods for supplier payments, payroll management, cross-border payments and access to credit, thereby accelerating the digital transformation of B2B payments.

Payment trends in Mexico are at a critical stage in the transition from cash dominance to digital payments. With the continuous advancement of technology and policies, and changes in consumer attitudes, Mexico is expected to further move towards digitalization in the payment field, gradually reducing its reliance on cash, and moving towards a more efficient and convenient digital payment era.