Recently, a piece of news has attracted widespread attention in the industry: Intel decided to pay Israeli employees an annual bonus equivalent to 0.8 months of salary, which is significantly reduced compared with the previous regular salary bonus of 2.5-3 months. In response, Intel said: "Bonuses will also be paid to employees based on business results this year."

However, judging from third-party statistics, Intel's current performance is not optimistic and it has fallen into a market crisis.

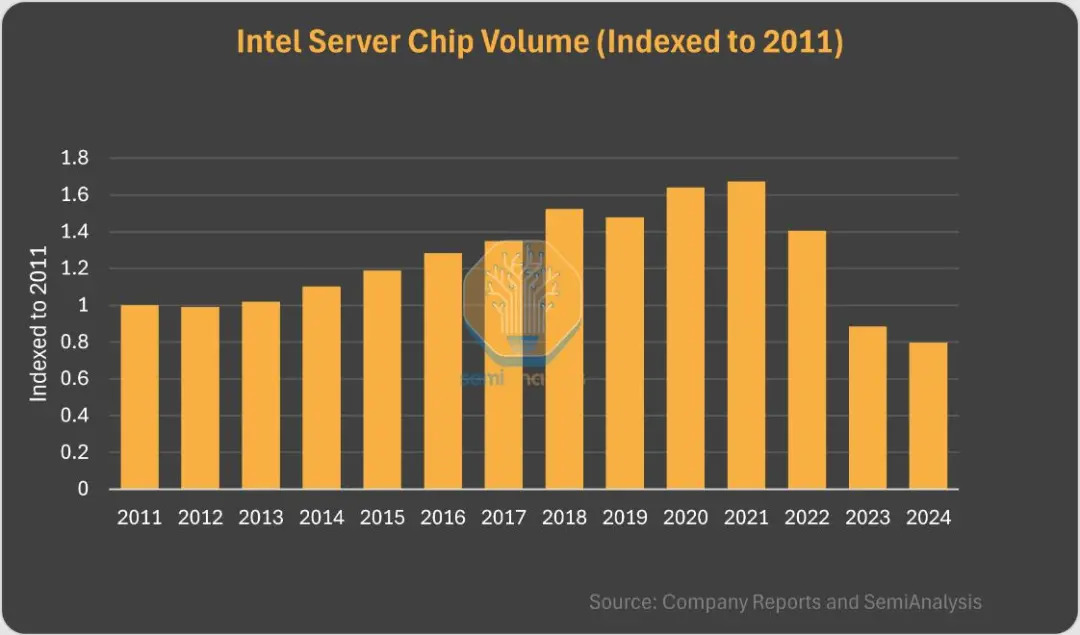

Data center shipments plummet 80%

According to Sravan Kundojjala, an analyst at SemiAnalysis, Intel data center CPU sales in 2024 will be 20% lower than in 2011, and will drop by more than 80% from the peak in 2021, reaching the lowest point in the past fourteen years.

On January 30th, local time, Intel released its fourth quarter financial report and full-year annual report for 2024. Although Intel achieved its best financial quarter in 2024, with revenue and gross profit margin reaching the highest levels of the entire fiscal year, from a full-year perspective, revenue and gross profit margin both experienced single-digit declines year-on-year, and the full-year net loss was as high as US$18.8 billion.

Behind the poor financial performance, Intel is facing huge impacts from companies such as AMD and NVIDIA at all core business levels, and its product competitiveness continues to weaken. Among them, the data center CPU business has repeatedly failed. With the boom in cloud data centers, Intel's sales in the data center CPU market have experienced significant growth since 2010. However, this growth did not continue, with AMD and competitors based on Arm architecture posing unprecedented challenges. At the same time, Intel's business in the data center field has suffered a major setback as demand for AI servers increases.

In terms of competitors, AMD's EPYC series processors have attracted the favor of many server manufacturers and data center operators with their high performance, low power consumption and other advantages, seizing Intel's market share. Taking the EPYC series of processors as an example, its product concept is in line with the current trend of explosive demand for AI computing power. AMD noted that many data centers are already running close to full capacity of available space or power. AMD EPYC processor-based servers deliver outstanding performance and energy efficiency to effectively consolidate workloads, freeing up more space and power in existing data centers to support new AI workloads. Data shows that 14 new AMD EPYC 9965 CPU servers can replace 100 original servers.

Clearwater Forest is defined as a product for Intel's counterattack in the data center business. However, Intel's progress in advanced processes and advanced packaging is currently mismatched. When catching up with TSMC's CoWoS packaging system, it has not yet broken through the yield bottleneck of silicon interposer micro-bump spacing (below 5 μm). Many people define this situation as a strategic "death cross", bringing great uncertainty to the future of this flagship product.

The latest statistics show that the global data center market is expected to expand at a compound annual growth rate of 15% - 20% by 2027, and the market prospects are relatively clear. However, industry insiders said that Intel needs to be alert that the data center business is shifting from traditional data centers to intelligent computing centers. In addition to facing challenges in the traditional cloud native market, the performance of Clearwater Forest in the inference market also needs to be further observed. Intel is paying for the lack of innovation in previous years.

Germany’s market share is less than 8%

From the data side, Intel not only faces difficulties in its core business and faces major impacts, but its performance in some important markets is also unsatisfactory. According to the latest data from the famous German retailer Mindfactory, AMD performed well in the German CPU market in January this year, accounting for 92.16% of total sales. In terms of sales revenue, AMD CPU revenue reached 8.3 million euros, accounting for 93.45% of total revenue; while Intel’s sales were 582,000 euros, accounting for 6.55%.

It is worth noting that AMD did not adopt a low-price competition strategy to seize the market. On the contrary, AMD CPUs are more expensive than Intel CPUs in Germany, with AMD’s average selling price being 352 euros and Intel’s 290 euros. Judging from market performance, the AMD Ryzen 7 9800X3D model processor became the best-selling CPU in Germany in January this year, with 8,390 units sold. Sales of Intel's Arrow Lake series processors fell short of expectations. Among them, the Core Ultra 7 265KF is the relatively best-selling model in the series, with only 50 units actually sold; while the Core Ultra 9 285K model at the top of the series has even more dismal sales, recording only 10 sales data.

It can be seen from the data center CPU and consumer CPU markets that Intel's problem of declining product competitiveness due to insufficient innovation is already very serious. Intel once led the industry with its “Tick-Tock” strategy (alternative process-architecture upgrade), but since the 14nm node in 2014, its process iterations have slowed down significantly.

Although the "Five Nodes in Four Years" plan has recently been proposed (such as Intel 7, Intel 4, Intel 3, etc.), the mass production progress still lags behind TSMC and Samsung. Now the highly anticipated Clearwater Forest processor has even encountered a "death cross" problem in process and packaging. The lack of synergy between process and packaging has exposed the shortcomings of Intel's vertical integration model. In terms of AI PCs, which are key to the consumer market, Intel has also missed a good opportunity. Although it has recently launched the Core Ultra series integrated NPU to promote AI PCs, market penetration still takes time, and competitor AMD's Ryzen AI has already taken the lead.

Big layoffs

The latest data shows that Intel has laid off more than 23,000 employees in the past two years.

The layoffs have had a certain effect, that is, Intel's performance improved last quarter, but what is even more frightening is that everyone has lost confidence in the future.

As of the end of 2022, 2023, and 2024, the number of Intel employees will be 131,900, 124,800, and 108,900 respectively.

In fiscal year 2024, Intel's revenue was US$53.1 billion, a decrease of 2% compared with US$54.2 billion in fiscal year 2023; net loss was US$18.8 billion, compared with US$1.7 billion in net profit in fiscal year 2023.

CEO Pat Gelsinger announced in October 2022 plans to cut spending by as much as $10 billion through 2025 in response to a sudden slowdown in demand.

Gelsinger was forced to step down in December 2024 after the board lost confidence in the turnaround plan.

At that time, in order to save the company, Gelsinger launched a major layoff plan, and more than 10,000 Intel employees lost their jobs.

No one expected that Gelsinger would also be laid off in the end.

Gelsinger originally hoped to return to Intel and retire after working for five years. Unfortunately, Intel did not give him this opportunity.

Bill Gates: Intel is in trouble

As major players in the global PC market, Intel and Microsoft have been working closely together, with one developing PC hardware and the other providing PC software.

Despite their success, both Intel and Microsoft missed out on the smartphone revolution of the late 2000s to early 2010s.

However, Microsoft has successfully recovered, while Intel has struggled.

Microsoft co-founder Bill Gates believes that Intel has lost its way and it will be very difficult to revive.

Rivals such as Nvidia and Qualcomm lead in AI and smartphone processors, while TSMC leads in process technology.

Concerns about Intel's future have intensified since CEO Gelsinger stepped down in December.

"I'm shocked," Bill Gates said. Gordon Moore always keeps Intel at the forefront.

Now Intel's chip design and manufacturing are lagging behind.

I think Gelsinger was very brave, he dared to say no, to solve the design problems, to solve the manufacturing problems.

I hope Intel can recover, but it looks like it's going to be pretty tough for them right now.

Intel rested on its laurels and missed the rise of artificial intelligence as a whole, both in terms of hardware and its investments in Open AI and other startups.

Morris Chang: Intel has lost respect

Apple rejected Intel as an iPhone chip manufacturer in 2011 and revealed that Intel did not understand wafer foundry at all.

In February 2011, Intel CEO proposed to manufacture iPhone chips for Apple, causing Apple to temporarily suspend negotiations with TSMC.

At that time, Intel already provided processors for Mac products.

At the Apple conference in March 2011, Cook made a decisive evaluation of Intel's foundry capabilities.

Morris Chang said that TSMC is superior to Intel in terms of manufacturing capabilities and customer trust.

I know many Taiwanese customers of Intel who don’t like Intel.

Intel always acts like it's the only player.

TSMC's success stems from its rapid response to customer needs.

When customers make various requests, we will try our best to meet each request.

Some are crazy and some are unreasonable, but TSMC always responds politely.

Intel has never done this.

This decision had a profound impact on the development of both companies.