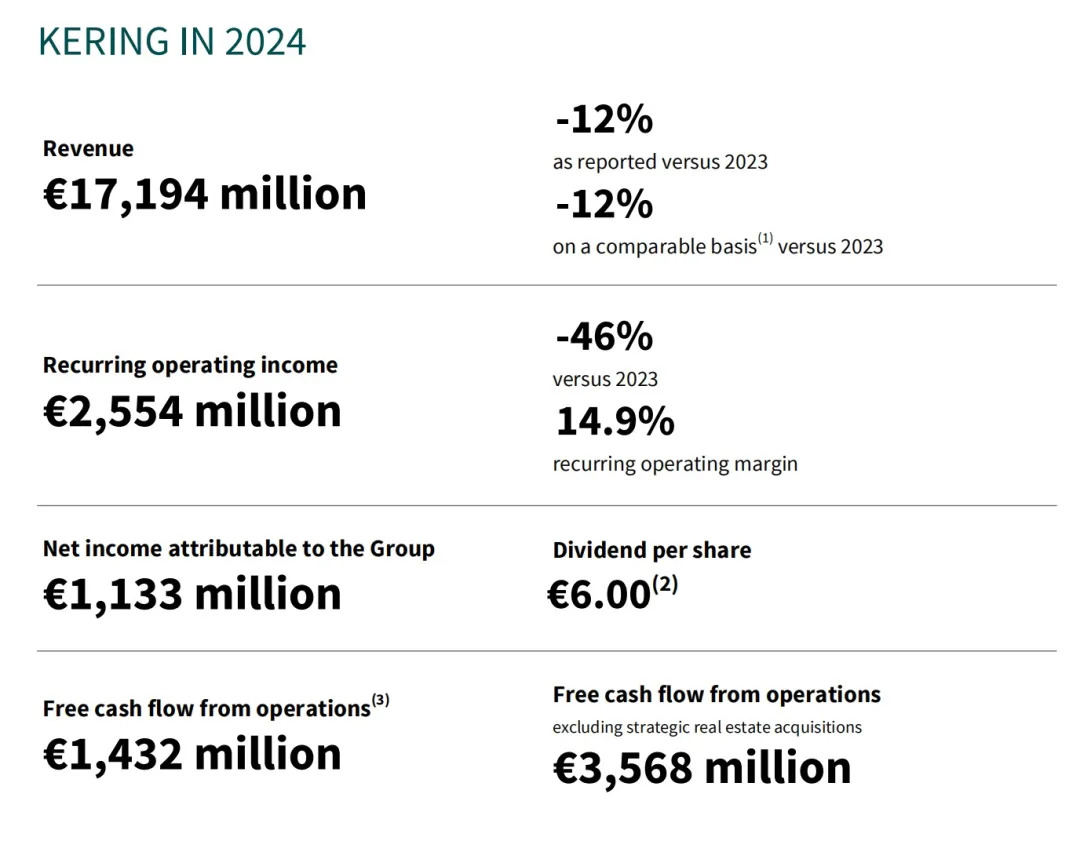

On the morning of February 11th, local time, luxury goods giant Kering Group announced its fourth quarter and full-year financial reports for 2024. Its full-year revenue fell 12% year-on-year to 17.2 billion euros, recurring operating profit plummeted 46% to 2.55 billion euros, and net profit attributable to parent companies fell sharply 62% to only 1.13 billion euros. In the fourth quarter, the group's revenue and comparable basis both fell 12%. Among them, the sales of the direct retail network fell by 13% year-on-year, wholesale and other revenue fell by 10% overall, and the wholesale revenue of core brands fell sharply by 25%.

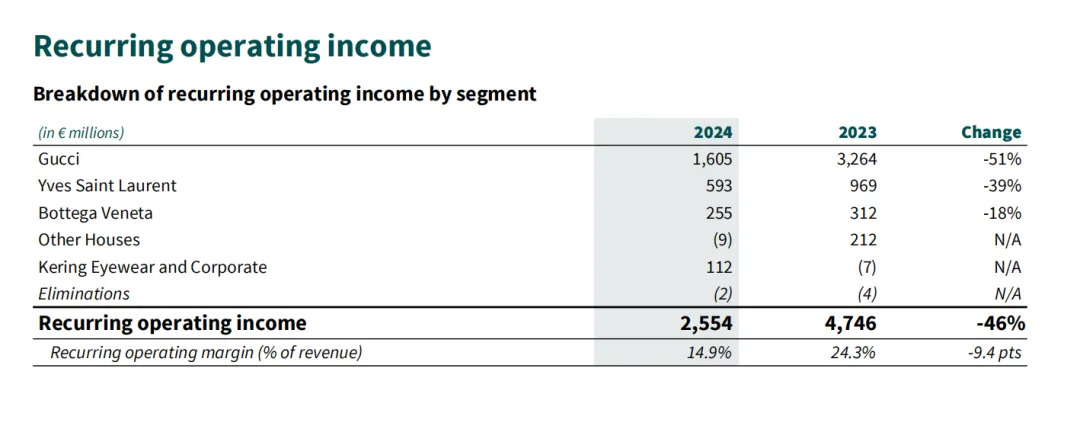

It is worth noting that the performance of the leading brand Gucci was weak, with full-year revenue falling 23% year-on-year to 7.7 billion euros, both retail and wholesale channels declining, profitability shrinking significantly, and recurring operating profit falling 51% to 1.6 billion euros. Yves Saint Laurent's full-year revenue fell 9% year-on-year to 2.9 billion euros, while Bottega Veneta's full-year revenue increased 4% year-on-year to 1.7 billion euros, becoming the only single core brand to grow. The full-year revenue of other departments fell 8% year-on-year to 3.2 billion euros.

Kering's report card is undoubtedly the comprehensive result of severe macroeconomic challenges, weak demand for core brands, and the pain of the group's strategic transformation. However, on the day the financial report was released, when European stocks closed, Kering Group's share price increased by 1.31% to close at 247.40 euros per share. The market and investors still seemed to have expectations for the industry giant's next move.

Recovery is not easy

Last month, the LVMH Group, a bellwether of the luxury goods industry, was the first to announce its full - year results for 2024. Although slightly higher than market expectations, it still greatly disappointed investors. Previously, the outstanding performance of the Richemont Group, the parent company of Cartier, had filled the market with expectations for the recovery of the industry. However, the continued weakness in LVMH's fashion and leather goods business, as well as its wine and spirits segment, undoubtedly reveals the reality of an intensifying internal divergence within the luxury goods industry.

Last week, Kering's stock price, which had fallen by more than 40% in the past year, rebounded due to the relatively outstanding performance of its peer Tapestry. This is mainly due to the overall positive expectations of the luxury goods market, rather than the improvement of Kering's own performance. The trend of consumption upgrades and brand leadership has made investors maintain optimistic expectations for leading brands.

The industry is recovering slightly, but Kering's performance is bleak, which inevitably makes the market and investors worry about its financial situation.

In 2024, Kering Group's net profit dropped significantly. Fortunately, the net operating cash inflow increased by 5.6% year-on-year to 4.709 billion euros, and the net financing cash outflow was 1.896 billion euros, reflecting the reduction in debt financing and continued dividend pressure. The net investment cash outflow was 3.185 billion euros, a significant decrease from the previous year, mainly due to the slowdown in acquisition activities.

In a conference call after the release of the financial report, Jean-Marc Duplaix, deputy CEO for operations and finance, said that Kering has currently made a net profit of 1.2 billion euros through the divestiture of real estate assets, including the sale of a majority stake in three buildings in Paris to private equity firm Ardian, and is expected to raise 2 billion euros or more through refinancing transactions in the next two years. Kering has no plans to invest further in real estate after last year's big acquisitions of Via Montenapoleone in Milan and Fifth Avenue in New York.

Luca Solca, senior global luxury goods analyst at Bernstein Research, previously said that in 2024, the operating profits of almost all brands released positive signals, but Kering Group still has a steep mountain to climb if it wants to return to its previous highs. Currently, Kering is still facing greater financial pressure and needs to shrink its business scale and concentrate resources on major markets and products. After conveying its confidence in crossing this cycle, its management said that the team is cautious about the prospects for 2025 and promises to limit expenditures, close stores and streamline operations in order to gradually return to profitability in the second half of the year.

Excessive cuts in R&D and design costs may harm the long-term viability of the brand. Kering Group should always maintain an overall profitable state. However, digitalization and artificial intelligence will transform its cost structure and profit model. In this process, the speed of response is crucial.

Gucci's dilemma

Since the second quarter of 2023, Gucci has fallen for seven consecutive financial quarters, and in 2024 it has maintained a decline of more than 20% in four quarters. Its revenue share within Kering Group has also dropped year by year from nearly 60% in 2020 to 44% in 2024, with the gap between 2023 and 2024 being as high as 7%.

Also since 2023, Kering's leading brand has successively changed the positions of creative director, senior executive vice president of corporate and brand strategy, and chief executive officer. One week before the release of the financial report, Kering announced the resignation of creative director Sabato De Sarno, who had served for less than two years. In response, Francesca Bellettini, vice president of Kering Group, said in a conference call that Gucci’s efforts in the past 18 months have not been in vain. Gucci will announce a new creative director as soon as possible, sooner rather than later, but the newcomer will not change the reform foundation established by the brand over the past period of time.

At a time when other brands are not yet fully fledged and the creative director of its leading brand is being replaced, Kering's future stock price performance will depend on whether Gucci can regain market favor through rebranding and innovative design. But in the pursuit of business growth, trendy culture and luxury status, Gucci has lost its balance. Even if management is full of confidence in Gucci in financial reports and conference calls, it is not easy to rebuild the brand image.

With the macroeconomic downturn and consumption concepts evolving, the luxury goods industry is facing the contradiction between homogeneous innovation and personalized consumption. Brands need to find a balance between digitalization and localized services. For leading brands, their mission is more to create new trends in the new environment. However, the trend of leading brands becoming dominant may also turn second - tier brands into market speculators, making it difficult for them to break through the existing pattern. Maintaining "not falling behind" is particularly important for leading brands such as Gucci whose performance has deteriorated.

During Sabato De Sarno’s tenure, many of Gucci’s designs were accused of “lack of attitude” and had homogeneity issues. Homogenization is a short-term behavior under the pressure of market competition. In the long term, it will weaken brand recognition and uniqueness. Beyond brand culture, the more critical long-term value lies in customer operations.

In addition, from the perspective of its own brands, in this financial report, Bottega Veneta, the only company under Kering Group to achieve growth, has always maintained high premium capabilities through exquisite craftsmanship and design. This feature has replaced its Logo as the core competitiveness of the brand. Gucci can learn from its low-key luxury characteristics, but the premise is to achieve a return to the brand image.

The beginning of spring has passed, but the spring of the luxury goods market seems to have not yet arrived.