Germany's decision to lift a cap on military spending and boost infrastructure marks a major policy reversal for the fiscally conservative country.

Germany is abandoning fiscal prudence to build its military and reshape its economy, in perhaps one of the most far-reaching changes in Europe sparked by Trump’s return to the White House.

Friedrich Merz, Germany's next chancellor, has announced that he will abandon the positions that have dominated Germany's partnership with Europe for decades.

Merz said that from now on, Germany's well-known strict fiscal rules will no longer apply to military spending, paving the way for the country to rapidly accelerate its rearmament.

The government will set up a 500 billion euro infrastructure investment fund to rebuild the country's long-neglected transport, energy and digital infrastructure.

Given the threat to freedom and peace on the European continent, everything had to be done. Germany needed to rearm, and to do that it needed to revive its economy.

Judging from the scale and openness of the spending plan, this spending spree will break Germany's traditional fiscal principles for decades.

Frugality has become a national ethos as successive German leaders have stressed the importance of sound public finances and economic stability, in light of the hyperinflation that led to Hitler's rise in the 1920s, the Great Depression of the 1930s and the eurozone debt crisis of the 2010s.

Taken together, the announcements mark Germany’s biggest adjustment yet toward reshaping its troubled export-reliant economic model, hoping to offset weak international trade and sluggish global demand for German goods by boosting domestic demand.

If approved, such a U-turn in fiscal stance could give neighboring countries a reason to increase military spending, something Trump has insisted European countries do.

The shift could also stimulate the region's economy, with Germany's arms purchases in particular likely to benefit businesses in the region.

“Germany and its European partners realize that this is not a fire drill and that Merz’s actions would have been considered too radical six months ago but now appear to be expected and necessary.”

Trump is pushing for a rapprochement with Russian President Vladimir Putin to convince Europeans that they will have to defend their own security, and spend real money to do so.

Germany has long sought to lead by example in Europe by limiting its own public spending to inspire and pressure other countries to follow suit.

Merz himself was one of Germany's strongest supporters of fiscal discipline. While he left the door open during his campaign to changing the strict fiscal constraints enshrined in the constitution, economists said the consensus reached this week was something else entirely.

“This is much more than just a reform, it seems Merz has decided that if his government is to succeed, fiscal spending will be essential.”

The plan still faces some major problems. Both the fiscal exemption and the infrastructure fund would involve constitutional changes, and there is no guarantee they would receive the two-thirds majority needed in parliament.

Merz and his future coalition partners have not yet decided how much to increase military spending.

Economically, Germany is likely to be the main beneficiary. Thanks to years of austerity, its public debt-to-GDP ratio is among the lowest in Europe.

But chronic underinvestment has also left it with an unstable rail system, unevenly distributed mobile networks, an aging power grid, and a public administration still stuck in the paper age.

Germany's blue-chip index rose more than 3% on Wednesday, close to a record high.

The market value of Rheinmetall, a defense company with about 30,000 employees, has soared to more than 50 billion euros. That's close to the market value of Volkswagen.

German government bonds had their worst day since the 1990s as investors anticipated more bond issuance. The 10-year German bond yield surged about 0.29 percentage points to 2.79%. Yields rise as prices fall.

Despite the sharp drop in bond prices, most economists believe Germany has enough room to borrow because of its low debt levels, but rising financing costs could make it more difficult for Europe's more indebted countries to increase military purchases.

Dusseldorf is one of four economists commissioned by Merz and his negotiating partners to produce a secret blueprint for the future government's defense and investment spending framework.

Simulations show a multiplier of 1.5 for infrastructure investment, meaning the €500 billion fund could translate into €750 billion in additional GDP by 2035, with little inflationary pressure.

By then, Germany's debt-to-GDP ratio could be 10 percentage points higher than it would have been without the fund. "But that may be a price worth paying to create a safer and more livable country."

Several private sector economists raised their growth forecasts for Germany. Morgan Stanley said the combined value of the defence and investment package could exceed 1 trillion euros.

Bank of America predicts that starting in 2027, Germany's annual growth rate could rise to between 1.5% and 2%, compared with a previous trajectory of close to zero.

Additional infrastructure investment would be around €50 billion per year over a 10-year period. Conservatively, this should increase annual GDP growth by 1 percentage point.

By raising the economy’s potential growth rate, infrastructure renewal can also make it easier for the country to grow without worrying about inflation.

Higher government spending creates jobs and household spending, which leads to higher tax revenues. This means that the extra spending sometimes pays for itself, leaving government debt as a percentage of GDP barely budging.

The incoming government has yet to agree on a full economic policy package. Excluding future military spending and infrastructure investment from the regular budget could make room for the corporate and income tax cuts Merz promised during his campaign.

Economists are somewhat divided over how military spending affects economic growth or whether it squeezes out private spending.

While infrastructure investments can pay for themselves, the benefits are less clear when it comes to military hardware, which acts more like an insurance policy.

Still, some say the impact could be positive, in part because Germany has spare capacity, such as underemployed workers or idle factories.

As the auto industry sheds jobs, Germany has plenty of skilled workers who could make a smooth transition to building trains or tanks. Rheinmetall reached a deal with Continental last summer to recruit redundant workers from the auto supplier.

“If you boost the industrial sector now, I do think some of that capacity could come back to the market.”

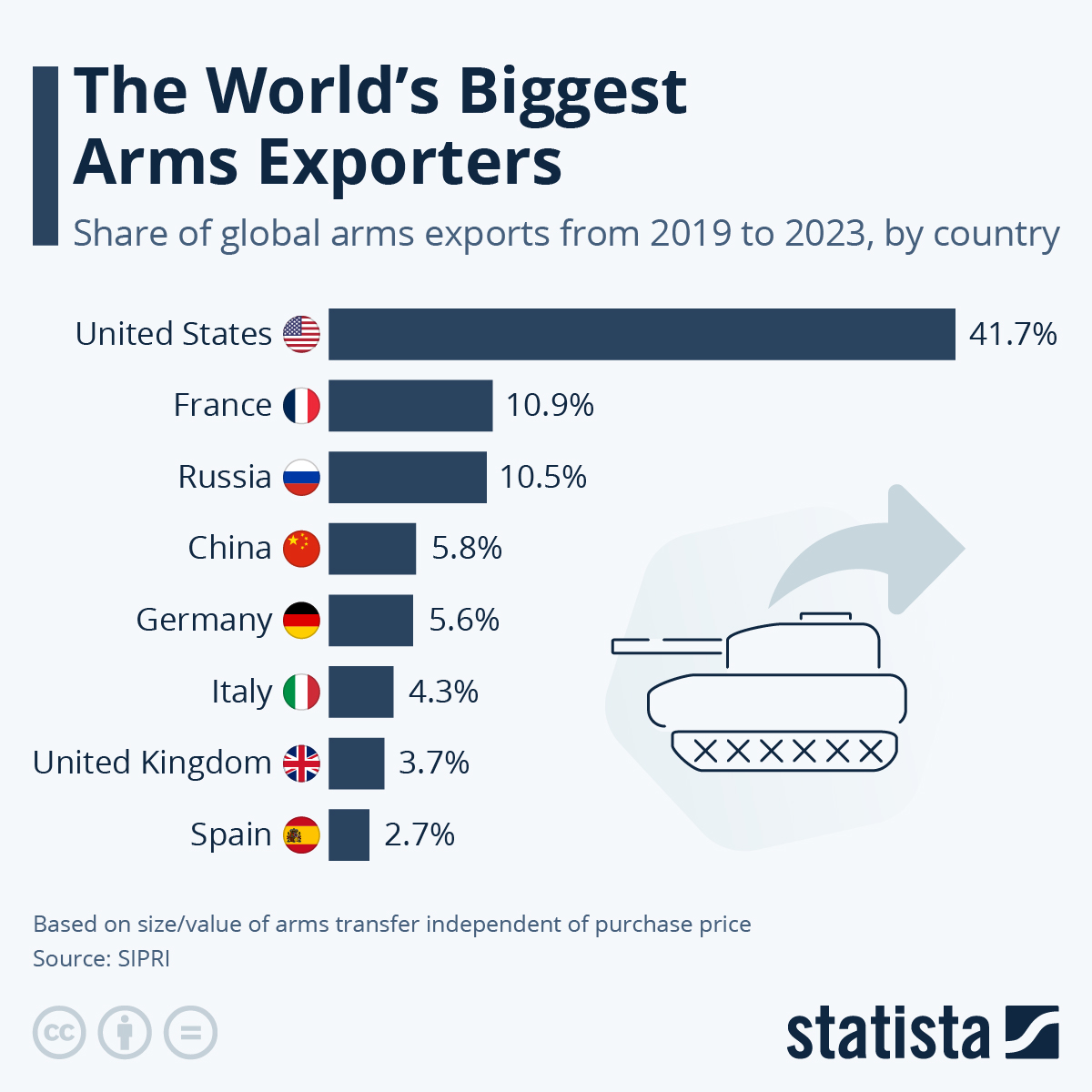

Economists also believe that Germany's defense sector could become a new source of exports. The Barclays report shows that between 2019 and 2023, the United States accounted for 42% of global military exports, while Germany accounted for only 5.6%.

Military spending can also boost productivity growth through spillover effects on the private sector. Historically, several military innovations have been transferred to the civilian sector, including the Internet and GPS positioning.

Silicon Valley's early growth in the 1950s and 1960s was largely due to defense investments.

A report by the Kiel Institute for the World Economics (IfW Kiel), a think tank, shows that if military spending as a percentage of GDP temporarily increases by 1%, it can increase long-term productivity by 0.25%.

But there are risks. The German economy has relatively low unemployment and a shortage of skilled workers. Companies may have trouble finding workers for large projects, which could lead to higher wages and inflation.

“Skilled workers are going to be hard to find when it comes to infrastructure.”

Most agree that Merz's bold move will do more good than harm, especially if it boosts economic confidence and encourages investment and consumption at a time of heightened geopolitical uncertainty.

“From an investment perspective, military spending makes Europe safer and it makes us less vulnerable to increasingly erratic U.S. presidents.”