Semiconductor giant Intel is in an existential crisis. The company lacks a permanent CEO, its foundry-focused strategy hangs in the balance, losses in market share have weighed on finances, and its artificial intelligence (AI) chip business has suffered major setbacks.

While Intel has a lot of problems, the server CPU business is one area where the company is making real progress. Rival AMD overtook Intel a few years ago with its Genoa series of chips, beating the market leader in core count, performance and efficiency. It took a while, but Intel finally found the answer last year with its Granite Rapids server CPUs.

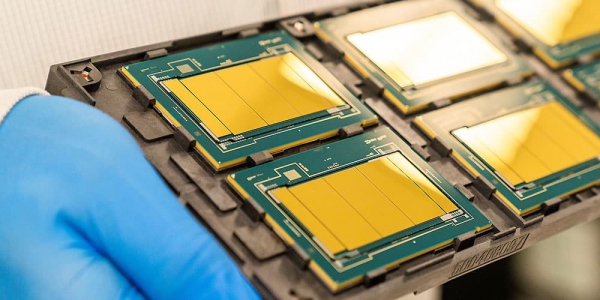

Granite Rapids is a key product for Intel. The chip series finally moves the company's mainline server CPU products from the aging Intel 7 manufacturing process to the more advanced Intel 3 process, a shift that brings significant performance and efficiency improvements. Intel was able to increase the maximum core count to 128, double that of its predecessor, and reviews suggest Intel has largely caught up to AMD in terms of performance.

Unexpected price reduction

One thing that came as a bit of a surprise at the Granite Rapids launch was the pricing. Intel decided to make a substantial move, setting the price of its flagship model at the highest level among x86 server CPUs. Considering Intel was still trying to catch up at the time, this pricing decision either showed that Intel was very confident in Granite Rapids, or that the company hadn't yet accepted that the competitive landscape today is very different than it was just a few years ago.

Tom's Hardware reported earlier this week that Intel had slashed the list price of its Granite Rapids CPUs without making an official announcement. The flagship model's current list price is $12,460, which is a full $5,340 less than the original launch price. Other models have also received price cuts, making them cheaper than similar AMD alternatives.

Notably, the price cut brings the per-core price of the highest-end Granite Rapids chips well below AMD's top chips, making Granite Rapids attractive to customers building dense cloud data centers.

There are a few ways to explain this price cut. First, Granite Rapids might not sell as well as Intel hoped. While the product line looks great, pricing it too high could drive away customers. Intel is set to report quarterly results on Thursday, so expect an update from the company.

The second interpretation of the move is that Intel is taking aggressive steps to regain market share. The company is still the leader in the server CPU market, but AMD has seen tremendous growth over the past few years. AMD's x86 server unit share was 24.2% in Q3 2024, up from 6.6% in Q3 2020.

The truth is probably a bit of both. Big price cuts could hurt Intel's profit margins, but that's not a foregone conclusion. Since Intel produces Granite Rapids in-house using the Intel 3 process, profit margins may not be affected that much if price cuts increase unit sales and improve utilization of the company's fabs. Intel 3 is a process that Intel offers to foundry customers, and the company may have excess capacity that needs to be filled.

Weaken AMD's development momentum

Whatever the reason for the price cuts, Intel's latest server CPUs are now more attractive than AMD's CPUs. AMD outsources manufacturing to TSMC, so if the company cuts prices as a result, it will eat into its profit margins.

One thing to keep in mind, though, is that the list prices for Intel and AMD server CPUs are not what big customers actually pay. Rather, they are an upper limit. Intel may have been offering deep discounts to cloud customers.

Regardless, Intel appears to be firing on all cylinders to try to get its data center business back on track and regain some of the market share it has lost over the past few years. With a stable and competitive product lineup, aggressive pricing may be just what the company needs to turn things around.